QuickBooks Accounting for Small Businesses

Leaping from the paper ledger or Excel spreadsheet to comprehensive accounting software like QuickBooks can be quite intimidating for several small business owners. However, familiarizing yourself with some essential features and principles can greatly simplify the process. Welcome to your ultimate guide on everything you need to know to master the basics of QuickBooks accounting for small businesses.

Grasping The Basic Principles for QuickBooks

Just like learning anything new, understanding the foundational principles of QuickBooks will make the learning process much smoother.

Understanding Double Entry Accounting

Double-entry accounting is an accounting principle where every financial transaction results in two equal and opposite entries in at least two different accounts.

Grasping Accounts and Chart of Accounts

The Chart of Accounts is essentially the backbone of your accounting system and is where all your financial transactions are recorded.

Mastering Items and Lists

Items are goods, services, or things that you sell, and Lists are databases of frequently entered items.

With a firm understanding of these principles, you’ll be well on your way to leveraging QuickBooks most efficiently for your small business needs.

Setting Up QuickBooks for Your Business

After gaining insights into the theoretical foundation, it’s time to set up QuickBooks.

Setting Up Your Company

Setting up your company correctly is crucial to maintaining accurate records.

Customizing Features

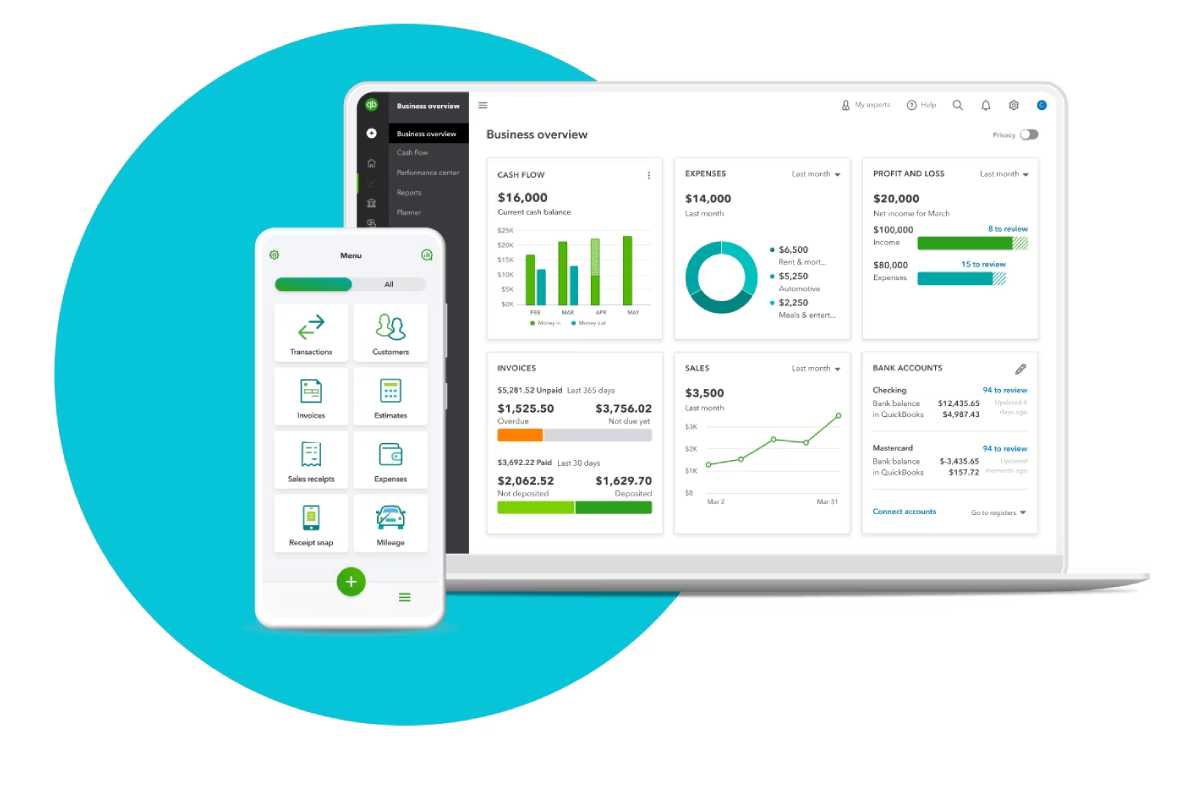

QuickBooks offers several features that can be customized to best suit your business’ accounting needs.

Configuring Sales Tax

The software has efficient tools to help manage and calculate sales tax applicable to your products or services accurately.

Once your QuickBooks system is optimized for your business, it becomes relatively easy to manage your financial transactions.

Maintaining Your Accounting

Maintaining your accounts regularly is critical to preventing any financial discrepancies and always staying updated with your business’ financial health.

Recording and Reconciling Transactions

Accurate recording and regular reconciliation of your transactions are vital to keep your accounts precise and up-to-date.

The QuickBooks accounting services help significantly in simplifying this process with their comprehensive suite of services.

Running Reports

Running regular reports on your QuickBooks allows you to continuously monitor your business’ financial health. These reports can provide detailed insights into the various income and expense categories, trends over time, and comparisons with prior periods. It not only helps in managing current cash flows but also assists in forecasting future cash flows. This level of granularity offers a unique lens to look at your business’ key financial metrics, enabling informed decision-making, and strategic financial planning.

Reviewing Financial Statements for QuickBooks

Reviewing your financial statements offers you an overview of your business’ profitability and financial standing. Three key statements – Income Statement (Profit and Loss), Balance Sheet, and Cash Flow Statement work together to give a comprehensive picture of your business health. The Income Statement provides information about revenues, costs, and expenses, helping you reflect on the profitability; the Balance Sheet reveals what you own (assets) and owe (liabilities); whereas the Cash Flow Statement gives insights into the operational, investment, and financing cash flows. Periodic review of these statements allows for a reality check, enabling you to take corrective measures wherever necessary.

Regular financial maintenance helps you stay on track, and the regular reports provide invaluable insights for your business growth. Additionally, this consistency in financial hygiene assists in maintaining accurate records, reduces the chances of missing important deductions, thereby saving on taxes, and prepares you for any audits. Ultimately, being on top of this pulse allows companies to be proactive rather than reactive, setting them up for sustained growth and success.

However, handling too many administrative tasks in-house can take away valuable time from focusing on your core business activities. Here, outsourcing to a virtual accounting service may provide significant benefits.

Conclusion for QuickBooks

Mastering QuickBooks accounting basics is a critical step towards successful financial management for any small business. Systems like these streamline business operations, help keep financial details in order, and make tax filing simpler. With a thorough understanding of the basics, small businesses can leverage QuickBooks to make their accounting processes efficient and effective, contributing to overall business growth and success.